CMA declines investigation into Big Pharma

Hello and welcome to the latest edition of The Counterbalance. This week, we’re taking a follow up look at the UK’s troubles with Big Pharma.

Three major pharmaceutical giants — AstraZeneca, Merck/MSD, and Eli Lilly — have each paused UK investments worth a combined £1.5 billion over the past year. The timing of their announcements, all within weeks of each other, raised suspicions that the firms were acting in concert to pressure the government into raising the prices the NHS pays for medicines.

Those suspicions prompted The Balanced Economy Project, Just Treatment, and Global Justice Now to write to the UK’s competition watchdog urging an investigation. This, we argued, showed signs of cartel-like behaviour that could have serious consequences for public health, and our story was featured in POLITICO last month.

Since, the CMA has responded to us and said they have “not seen any direct evidence that the public announcements were made as a result of anti-competitive collusion…nor is it obvious to us that this could be reasonably inferred from the timing and nature of the announcements alone.”

“To hear this from the UK’s anti-trust regulator body is extremely disappointing and bad form,” said The Balanced Economy Project, Just Treatment and Global Justice Now in a shared statement. “In short, they’re saying if there is a secret agreement then we don’t know about it and therefore can’t investigate it.”

The CMA’s refusal to investigate the alleged anti-competitive coordination is, this time, far more concerning than a disappointing regulatory decision. It is the latest and clearest example of how the UK’s chief competition watchdog’s reticence to show its teeth since the government imposed it’s “growth at all costs” agenda on regulators.

In other words, the CMA’s stance is difficult to separate from the political climate in which it operates. As The Counterbalance reported recently, the regulator has explicitly aligned itself with the government’s mission, promoting competition not as a public safeguard but as a tool for “unlocking investment” and “increasing business confidence.”

The CMA’s leadership change earlier this year, where former Amazon executive Doug Gurr replaced Marcus Bokkerink, symbolised a broader realignment that is now appearing in the substance of CMA decision-making. While the previous CMA would stand firm against corporate concentration, the watchdog in its current iteration has shown itself to clearly evaluate its actions through the lens of market confidence and political missions.

Just over a year ago, the CMA’s decision to block Microsoft’s then-proposed takeover of Activision — the video game giant behind the world famous Call of Duty series — was hailed as a landmark decision. The Balanced Economy Project praised the move as a “courageous step in the face of furious lobbying and opposition from the two US giants.”

But the reversal of that decision, and the subsequent approval of the deal under political pressure, have also undone that progress. Former US Federal Trade Commission chair Lina Khan recently said that the merger is already producing the very harms that we warned against, as Xbox Game Pass prices have increased and consumer choices have been limited.

“As dominant firms become too-big-to-care, they can make things worse for their customers without having to worry about the consequences,” Khan said in a post on X.

Khan is right, but the cost of caution in this instance is far greater than rising costs for gamers.

In the case of the pharmaceutical industry, inaction has serious and tangible consequences for people’s health. The NHS already pays inflated prices for many essential medicines thanks to entrenched health sector monopolies. If large firms can coordinate to extract even higher prices, then the public is ultimately paying twice: once through higher drug costs and then again through poor regulatory oversight.

The Balanced Economy Project and other groups have raised alarm bells because the CMA’s logic is circular: refusing to investigate because there is no evidence — when only an investigation can uncover said evidence — is simply not good enough.

The UK’s principal watchdog once showed what independent, public-interest enforcement looks like. Today, under the government’s false premise of growth at all costs, that enforcement is at risk of being sidelined.

This pharmaceutical case – like Microsoft-Activision Bllizzard, Vodafone, and the housebuilders cartel decision before - exposes how routine the UK’s current political direction is within regulatory circles, and if this trend continues the UK risks sliding toward a reality where anti-competitive behaviour becomes normalised and without sanction.

Competition policy must serve the public interest, not the government’s policy goals or industry’s investment strategies. Restoring this balance is essential if Britain is to rebuild a truly democratic economy that works for the public and not the powerful few.

Weekly highlights:

Almost 30 million Apple and Samsung smartphone users in the UK may be set to receive part of a potential £480 million payout following a class action lawsuit brought by Which? Against tech giant Qualcomm. The proceedings, which began this month in London, are set to investigate whether Qualcomm exploited its substantial market power.

Mars’ $36 billion bid to acquire Kellanova, the company behind Pringles, appears to be on the brink of clearing a major hurdle by winning EU court approval according to a scoop landed by Reuters. The deal — which has already secured a blanket approval from US authorities — would bring M&Ms, Snickers and Whiskas cat food all under the Mars banner.

Soundbite of the week: Critical risks

One of the most commonly forgotten harms caused by monopolies and concentrated wealth is how much they undermine some of the most critical sectors of society.

Matt Stoller’s BIG took one of those subjects earlier this year, publishing a piece on how private equity degraded the ability of fire services to respond to the Los Angeles fires.

This week the International Association of Fire Fighters laid bare how significant the challenges have become. Chicago, IL Local 2 President Patrick Clearly had this to say:

“We’ve had engines go out on calls with faulty brakes and had to crash them into buildings to stop them. We had a crew whose truck broke down and there were no spares available, so our members were just sitting in the firehouse for days with nothing to do…it’s gotten really bad over the last three years. The spare rigs we’re being forced to use are older than a lot of the members we have operating them.”

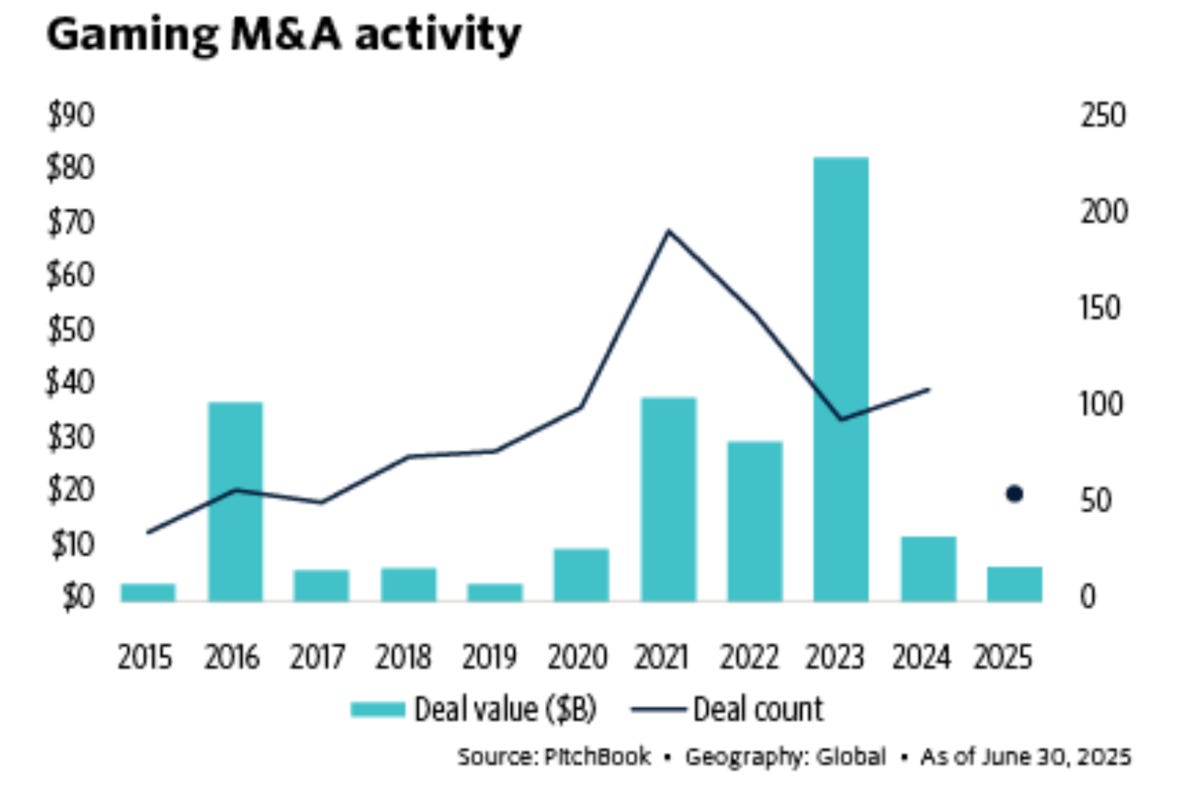

Data mining: A final word on gaming

Activision Blizzard is not the only gaming giant generating controversy these days.

The planned $55 billion deal that would take Electronic Arts — the developer behind the world’s most popular sports game franchises — signals the Gulf region’s ambition to diversify beyond oil and into interactive entertainment, according to PitchBook’s latest analyst note.

The deal is being pitched as an opportunity for EA to utilise private ownership in order to experiment with new gaming models, as well as AI-driven entertainment. However, as Lina Khan’s frustrated tweets remind us, increasing wealth concentration in the gaming industry results in little more than harm to consumers, and in the long run, a watered down and more expensive product.

The Counterbalance is published every Thursday. Please send any thoughts and feedback to scott@balancedeconomy.org.