Power, capital, and the UK's growth agenda

Hello and welcome to the latest edition of The Counterbalance. Today, we're taking a look at the UK's growth agenda.

For the last two weeks, Counterbalance has drilled home the need to look at the fight against corporate power through the lens of different countries. This week we’re turning our attention to the UK.

The City of London provides plenty to chew on here when it comes to unchecked power and big capital.

The UK’s competition watchdog, the Competition and Markets Authority, has been making headlines since the turn of the year when Doug Gurr — a former Amazon executive — was chosen to lead the regulator and succeed Marcus Bokkerink.

Under Bokkerink’s leadership, the Department of Business and Trade believed the CMA was not paying sufficient attention to the UK’s growth agenda under a new Labour government, so much so that the regulator was scolded by Prime Minister Keir Starmer last October:

“We will make sure that every regulator in this country, especially our economic and competition regulators, takes growth as seriously as this room does.”

The latest evidence that Starmer’s promise has taken hold of the CMA came earlier this week, when the regulator opened the door to a potential SLB / ChampionX merger, following remedies being offered by the parties. The roughly £6 billion deal could consolidate roughly 70% of the UK’s oilfield services market.

For those watching closely, the announcement may have come as a surprise, given that just last month the CMA said it was worried the merger could “result in a substantial lessening of competition”.

The CMA’s latest move is a further sign of the regulator changing direction on remedies. Should no new concerns arise the deal should be cleared within 40 working days.

But as Tom Smith, competition law specialist of Geradin Partners puts it, these accepted remedies are “more evidence on the new-look UK merger control regime.”

It is also crucial to understand that this move is part of a wider pivot in the name of a new UK government agenda, that “deregulation equals growth”. The government’s belief is that a less regulated environment can allow the UK to stimulate growth and compete more effectively around the world.

But what does that mean in practice? Is it about clearing the UK from the burdens of red tape that hold back SMEs and consumers alike, or is it simply about an easier route to business for the most powerful?

So far, the government has presented scant evidence of the former. As we highlighted in our latest submission to the CMA, competition is beneficial to long-term growth, not an obstacle to it.

In fact, previous case studies tell us that a loosened grip on merger control actually harms growth. Our submission to the CMA against the Vodafone/Three merger — which the regulator approved late last year — forecasted an eventual doubling of prices for the lowest cost mobile packages, a 15 per cent average rise in mobile prices, as well as at least £2 billion in annual costs to the UK.

It’s not just a UK issue, either. Economist Isabella Weber has looked at how other countries have experimented with mass deregulation only to discover that this does not lead to growth and a thriving, healthy free market.

But we need more than just facts and figures to bust the “deregulation = growth” myth. We need to tackle the problem of entrenched political narratives that define the terms of debate in the first place.

To that end, I will leave you with a personal anecdote that, I believe, demonstrates how political the UK’s “growth at all costs” agenda has become.

In a previous life as an FT reporter, I sat in on an All-Party Parliamentary Group session on cryptocurrencies and digital assets in Westminster. Facing calls for tougher oversight, crypto industry lobbyists would tell anyone who would listen that the government needed to remove regulations that “stifle growth” and “undermine innovation”.

Crucially, this APPG took place in the aftermath of crypto’s biggest ever scandal, the FTX collapse, so you might assume Westminster had little patience for industry lobbyists.

You would be wrong. During the session one member of the House of Lords — who will remain unnamed — held up a recent copy of the FT and lambasted an article of mine that revealed links between crypto payments and child sexual abuse material.

They pressured industry to “avoid” stories that turned away public support and instead challenged them to help the government deliver (yes, you guessed it) the “growth and innovation” the UK was looking for.

If Westminster’s growth agenda has the stomach to wade through scandals like that, then we really do have a fight on our hands.

Data mining: Big Tech’s spending spree

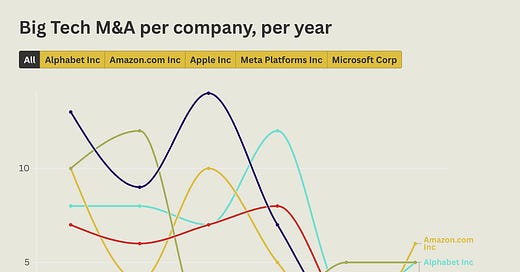

Researchers at the Center for Research on Multinational Corporations (SOMO) have unveiled new research that reveals how quickly Big Tech companies are tightening their stranglehold on markets through a series of mergers and acquisitions.

According to the data, compiled by Çağri Çavuş, Margarida Silva and Jasper van Teeffelen, Big Tech firms make a fresh acquisition every 11 days.

You can see their new M&A tracker here.

Weekly highlights:

“Deregulation = growth” may be high on the UK’s agenda these days, but as irony would have it, the government kicked off the week rescuing British Steel, a steelmaking plant that was set to close down next month. The move comes after the government recalled Parliament over the weekend to pass emergency legislation. The Scrunthorpe facility is the main producer of steel for British railways and if it were to shut, the UK would be forced to rely heavily on critical infrastructure imports.

Dr. Kris Shrishak, a senior fellow at the Irish Council for Civil Liberties said via the Tech Policy Press that the European Commission’s AI Continent Action Plan is “closer to fiction than reality”, adding that Europe will “burn more fossil fuels” in a bid to lead the world on artificial intelligence.

The “bonfire on rules” looks set to continue as the US Federal Trade Commission launches a public inquiry into the “impact of federal regulations on competition”. The goal of the inquiry is to identify and reduce any anti-competitive regulatory barriers. The inquiry comes after President Trump’s Executive Order on Reducing Anti Competitive Regulatory Barriers.

Soundbite of the week: Meta slammed in the US Capitol:

A potentially watershed moment in competition law also kicked off this week as Meta faces trial in the United States over claims it built an illegal social media monopoly through acquisitions of Instagram and WhatsApp.

Daniel Matheson, an attorney at the Federal Trade Commission, said Meta’s business strategy…

“...established entry barriers that for more than a decade protected Meta’s dominance…consumers do not have reasonable alternatives they can turn to.”

The Counterbalance is published every Thursday. Please send any thoughts and feedback to scott@balancedeconomy.org.